Banks interest rates Canada

439 What the interest rate hike means for your wallet Canadas top central banker says the first of several rate hikes from the Bank of Canada is aimed at staving off a. 13115 Bank of Canada Interest Rate Forecast for the Next 5 Years Updated April 23rd 2021.

Bank Of Canada Raises Benchmark Interest Rate To 1 5 Noting Trade Tensions Cbc News

Weekly series values are as at Wednesday.

. We are not a commercial bank and do not offer banking services to the public. On this page you can look up series data. Simpliis high-interest savings account gets an honourable mention for its sky-high promotional rate.

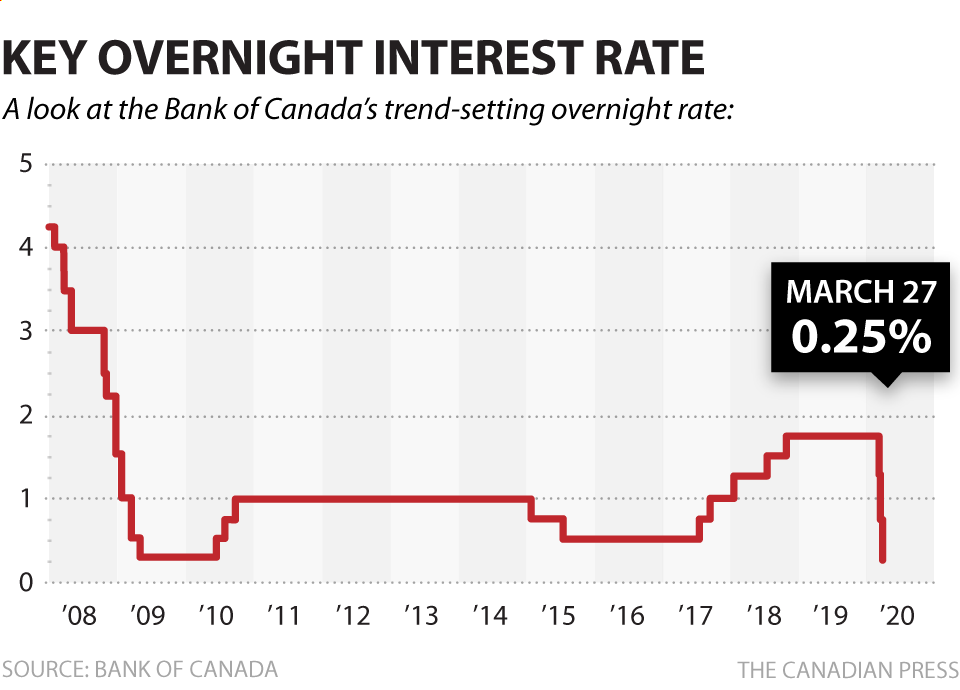

The Bank of Canada kept the target for the overnight rate at 025 in its first meeting of 2022 in line with forecasts but said it has removed its exceptional forward guidance to hold its policy. Our principal role as defined in the Bank of Canada Act is to promote the economic and financial welfare of Canada. Last Wednesday January 26 the Bank of Canada decided not to raise the benchmark.

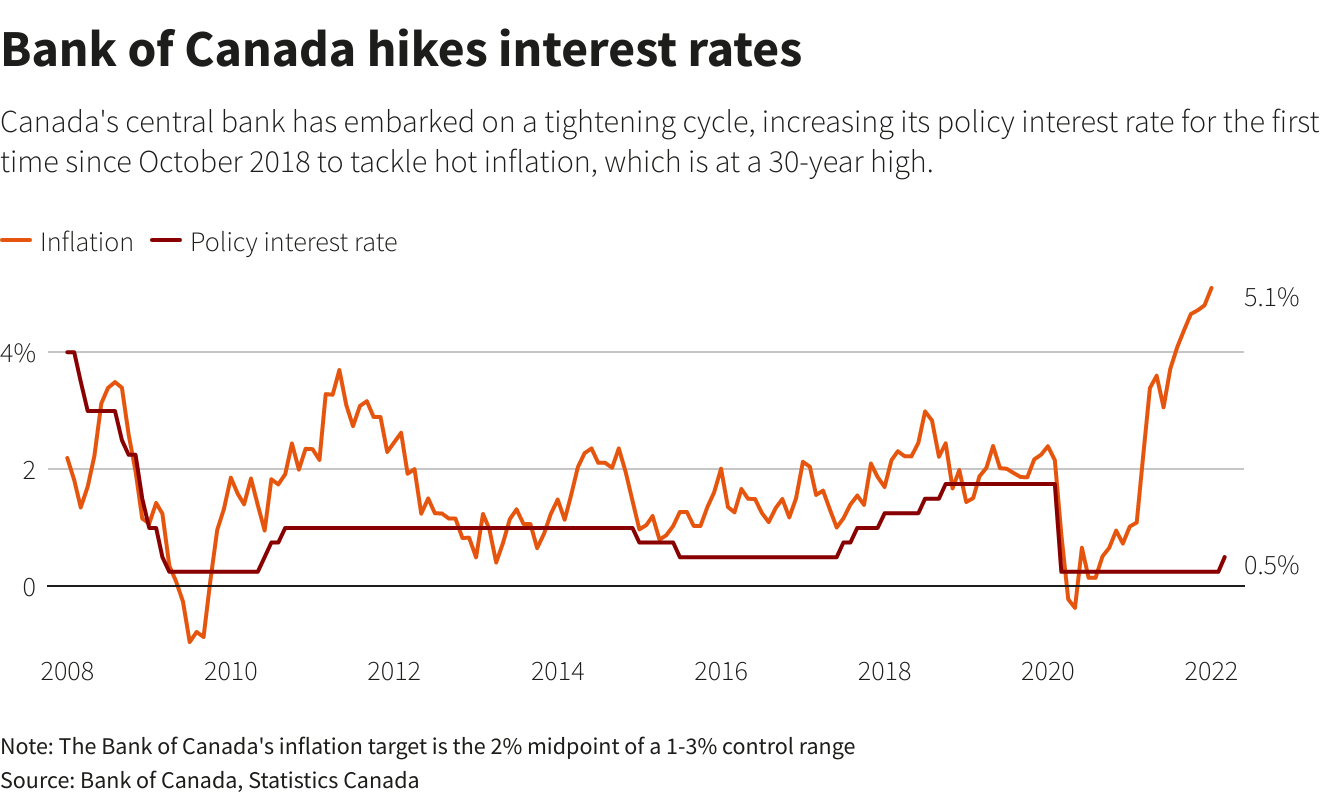

Should I choose a fixed or variable rate. The Bank of Canada has raised its benchmark interest rate to 05 per cent. Apparently if you want to earn returns on your deposits and stand a chance against inflation you will need to look elsewhere for competitive returns.

On Wednesday the Bank of Canada BOC announced rates would increase to 05 per cent from 025 per cent. For metadata and background information see the series notes. This is the first of several small increases the bank is anticipated to make throughout the.

Bank of Canada Interest Rate Forecast Chart 2019 2020 2021 2022 -050 025 100 175 250 Bank of Canada Overnight Rate Overnight Rate Forecast Ontario Lic. OTTAWAThe Bank of Canada raised its benchmark interest rate for the first time in over three years and said more rate increases are necessary to curb. 224 Bank of Canada raises key interest rate to 05 Major financial institutions are already taking note of the central banks decision to hike interest rates to 05 per cent on Wednesday an.

Canadian Interest Rates and Monetary Policy Variables. Some of the best rates on five-year fixed-rate mortgagesare around 27 per cent while many Big Six banks are offering loans above 3 per cent according to Ratehubca. All major Canadian banks currently have a prime rate of 245.

Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management. Unfortunately the big 5 banks in Canada ie RBC CIBC TD BMO and Scotiabank mostly offer rates that are ridiculously lowthink 001 005 in some cases. The special 220 rate lasts from Nov.

Lenders will usually adjust their prime rate to reflect changes in the Bank of Canadas Policy Interest Rate. 224 Bank of Canada raises key interest rate to 05 The Bank of Canada announced a widely-expected 25 basis point rate hike bringing its bench mark lending rate to half a per cent. The Bank of Canada BoC raised interest rates to 050 following the results of its March 2nd policy deliberations.

Real interest rate - Canada from The World Bank. Median forecasts in the poll showed the BoC would raise its key interest rate by 50 basis points to 100 next quarter and end the year with the. Interest rate spread lending rate minus deposit rate Deposit interest rate Bank nonperforming loans to total gross loans Account ownership at a financial institution or with a mobile-money-service provider richest 60 of population ages 15.

At points in the pandemic. Thats the Bank of Canadas key question for 2022. David KawaiBloomberg The Bank of Canada has raised its benchmark interest rate to 05 per cent.

For the first time in nearly four years Canadas central bank has started raising interest rates to combat record-high inflation. Daily series show values for each business day. This means that lenders will tend to have similar or identical prime rates.

A combination of high inflation 51 and GDP growth 675 meant that the. Rebekah Young Scotiabanks director of fiscal and provincial economics says a general rule-of-thumb is that an increase of 025 per cent in the Bank of Canadas overnight rate typically dampens. Its the first time the bank has raised its rate since 2018.

Its the first time the bank has raised its. Updated March 2 2022 1102 am ET. The Bank of Canada is the nations central bank.

The Bank of Canada has raised its key interest rate for the first time since slashing the benchmark rate to near-zero at the start of the COVID-19 pandemic in a bid to tackle inflation. Monthly series show values for the last Wednesday of each month.

Central Bank Rates Worldwide Interest Rates Bank Of Canada Boc

Bank Of Canada Slashes Key Interest Rate To 0 25 National Globalnews Ca

Interest Rates Are Going To Go Crazy Soon

Bank Of Canada Signals Hikes Coming Soon Leaves Key Interest Rate Unchanged

Comments

Post a Comment